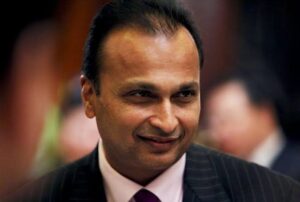

Anil Ambani’s Reliance Group Responds to ED Raids, Addresses Yes Bank Transactions

Anil Ambani’s Reliance Group issued an official clarification regarding the allegations which has appeared in recent media reports and the actions initiated by India’s Enforcement Directorate (ED) on Thursday, 24 July 2025.

“Reliance Group wishes to clarify certain recent media reports concerning the actions initiated by an enforcement agency. These reports appear to pertain to allegations in relation to transactions involving Yes Bank and Reliance Home Finance, which are more than 8 years old,” said the company in a white paper release.

ED Raid

The Enforcement Directorate (ED) on Thursday conducted simultaneous searches at more than 35 premises across Mumbai and Delhi, as part of a money laundering investigation under the Prevention of Money Laundering Act (PMLA).

According to media reports, ED conducted the raids on Thursday in connection with an alleged ₹3,000-crore bank loan fraud involving Anil Dhirubhai Ambani Group companies and Yes Bank. The reports also mentioned that the investigation on Thursday was conducted across 50 companies and 25 individuals.

Anil Ambani is the former managing director and chairman of the Reliance Group of companies, as of current date, Thursday, 24 July 2025.

Here’s what Reliance Group says

1. Loan Allegations: On the allegation, ED found out that just before the ₹3,000 crore loan was granted, Yes Bank promoters received money in their concerns. The company now claims that the loans sanctioned to “certain private companies” of the promoter, Yes Bank, were “sanctioned on merit.”

They also said that the loans were “fully secured and have been fully repaid”, including the interest, making the outstanding amount nil.

“Loans extended by Reliance Home Finance Limited (RHFL) to certain private companies of the promoter of Yes Bank were sanctioned on merit, after following the due process, and were duly approved by a credit committee comprising more than 30 individuals. These loans were fully secured and have been fully repaid, including interest, and the outstanding is zero,” said the company.

2. Loan Approval Violations: ED alleged that it found

gross violations in Yes Bank loan approvals to Reliance Group firms. They reportedly found that there were backdated Credit Approval Memorandums (CAMs), proposed investments without due diligence in violation of the bank’s credit policies.

The company refuted the claims and said that the loans were granted after “due process” and the entire Reliance Group companies’ exposure was “fully secured.

“Yes Bank had granted loans to Reliance entities after following the due process. The entire exposure of Reliance Group companies is fully secured and was undertaken strictly in the ordinary course of business. All transactions between Reliance Group companies and Yes Bank have been carried out in complete compliance with applicable laws, regulations, and financial norms,” said Reliance Group.

3. SEBI Findings: Reports also emerged on the capital

markets regulator (SEBI) finding a “dramatic increase” in corporate loans by Reliance Home Finance Limited (RHFL). As per the allegations, the loans rose from 3,742.60 crore in FY2017-18 to ₹8,670.80 crore in FY2018-19.

Anil Ambani’s Reliance Group said that the allegations were addressed in a SEBI order passed in August 2024, which was later challenged in the Securities Appellate Tribunal (SAT), and still remains under judicial consideration.

“Allegations similar to those referred to in the media reports were addressed in an order passed by SEBI in August 2024. This order has been challenged and is currently pending adjudication before the Hon’ble Securities Appellate Tribunal (SAT). The matter is thus sub judice,” said the company.

“The debt resolution process of Reliance Home Finance led by Bank of Baroda stands resolved pursuant to the judgment of the Hon’ble Supreme Court of India dated March 2023,” said Anil Ambani’s Reliance Group.

The company also said that Reliance Communications and Reliance Home Finance are not part of the Reliance Group. “RCOM and RHFL are not part of the Reliance Group,” they said, as per the white paper.

More Stories

9 carat is becoming a cheaper alternative to expensive gold, know which gold carats are available in the market

All Set for July 30: NSDL’s ₹4,000 Cr IPO Marks Retail’s Chance in Market Infrastructure!

Moscow on Alert: Russia Closely Watching as US Nuclear Arsenal Returns to Britain